Everything You Need to Know About Pocket Option Tax Form

Ganar dinero con la opción de bolsillo is not only about making profits through trading but also understanding your tax obligations. As a trader, it’s essential to comprehend the intricacies involved in your Pocket Option Tax Form and how it can affect your financial commitments.

Introduction to Pocket Option Tax Form

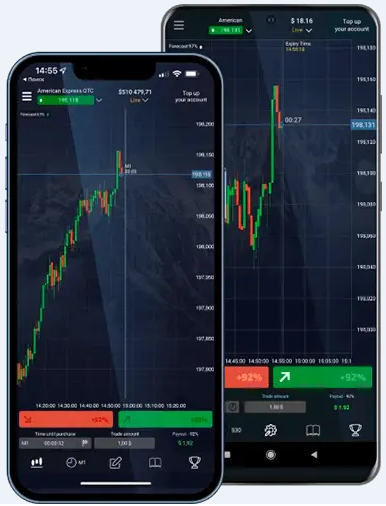

In the increasingly popular realm of online trading, Pocket Option has emerged as a favored platform for traders globally. While engagement in online trading can be lucrative, it’s critical to maintain awareness of the tax implications attached to your trading activities. This is where the Pocket Option Tax Form plays a pivotal role. Understanding and accurately completing your tax forms ensures compliance with tax authorities and helps avoid potential legal issues.

Understanding Your Tax Obligations

Whether you’re a novice trader or an experienced professional, the Pocket Option Tax Form is an essential component of your financial strategy. It provides a comprehensive overview of your earnings and losses associated with binary options trading on the Pocket Option platform. Failing to adhere to the tax regulations can lead to penalties or more severe consequences.

Types of Income to Report

While trading in Pocket Option, you may encounter various types of income that need to be reported. These include but are not limited to:

- Capital Gains: Profits made from the sale of options over the purchase price.

- Interest Income: Occasionally, profits or settlements might generate interest income.

- Dividends: If applicable, dividends may also form part of your taxable income.

Make sure that your Pocket Option Tax Form reflects these incomes accurately.

Filing Your Pocket Option Tax Form

Filing your Pocket Option Tax Form involves several steps, including gathering your documentation, understanding the applicable tax rate, and ensuring all income is reported correctly. Here’s a step-by-step guide:

Step 1: Gather Documentation

Ensure you have all necessary documents at hand. This typically includes your trade statements, proof of income, and any other relevant documents you receive from Pocket Option.

Step 2: Determine Your Tax Rate

Your tax rate on binary options may vary depending on your country of residence, the nature of your trading activities, and specific tax laws applicable at the time. Some regions categorize options trading as a form of gambling while others treat it as capital gains.

Step 3: Accurate Reporting

Ensure that all your earnings from trading activities are accurately reported. Double-check your calculations and documentations to avoid errors. Mistakes in your tax form could lead to audits or penalties.

Tools and Resources

There are several tools and resources that make managing your Pocket Option Tax Form easier. Consider utilizing tax software that includes features specific to binary options trading. Additionally, consulting a tax professional can provide personalized guidance based on your individual circumstances.

Important Considerations

Several factors need to be considered when dealing with your tax obligations:

- Keep Detailed Records: Maintain comprehensive records of all transactions on the Pocket Option platform.

- Deadlines: Be mindful of tax filing deadlines to avoid late fees or penalties.

- Updates to Tax Laws: Stay informed of changes to tax regulations that may impact your reporting requirements.

Conclusion

Understanding and managing your Pocket Option Tax Form obligations are integral to successful long-term trading through the Pocket Option platform. By staying informed and following the outlined steps, you can ensure compliance and peace of mind.

Remember, while the process can be daunting, multiple resources are available to assist you in your tax filing efforts. Adopting a proactive approach to your taxes will ultimately benefit your financial health and trading endeavors on platforms like Pocket Option.